Savings and Spending Accounts

Savings and spending accounts allow you to contribute money before taxes are withheld to help cover the cost of caring for you and your dependents.

Collection

Course

Savings and Spending Accounts

Savings and spending accounts allow you to contribute money before taxes are withheld to help cover the cost of caring for you and your dependents.

Savings and spending accounts allow you to contribute money before taxes are withheld to help cover the cost of caring for you and your dependents.

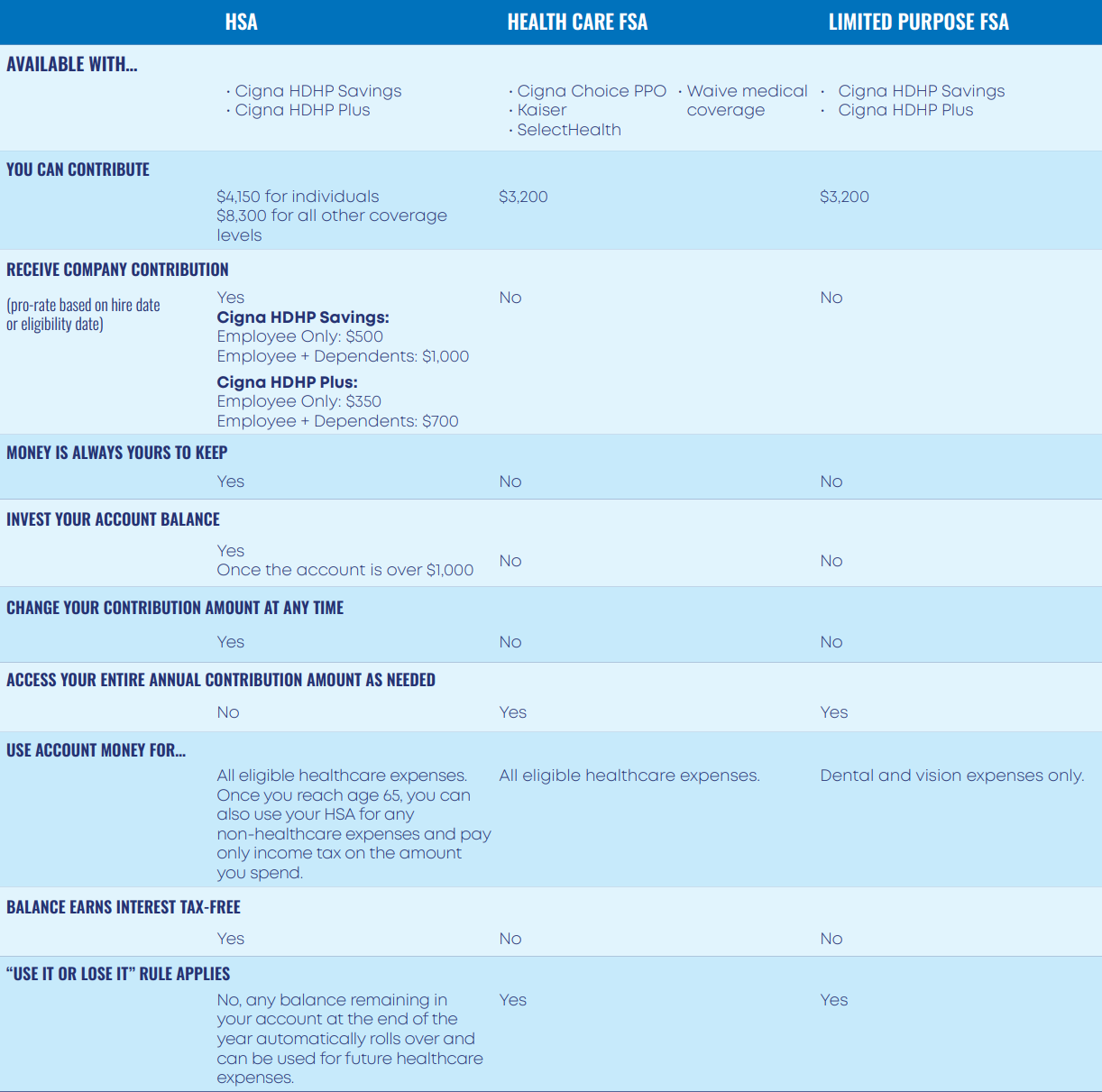

Savings and spending accounts allow you to contribute money before taxes are withheld to help cover the cost of caring for you and your dependents. Danone offers three tax-advantaged accounts—the Health Savings Account (HSA), the Health Care Flexible Spending Account (FSA), and the Limited Purpose FSA. As you consider your medical selection, it’s important to understand the account options available for each plan.

The medical plan you enroll in will determine which tax-advantaged savings account you may contribute to. See how they compare in the chart below.

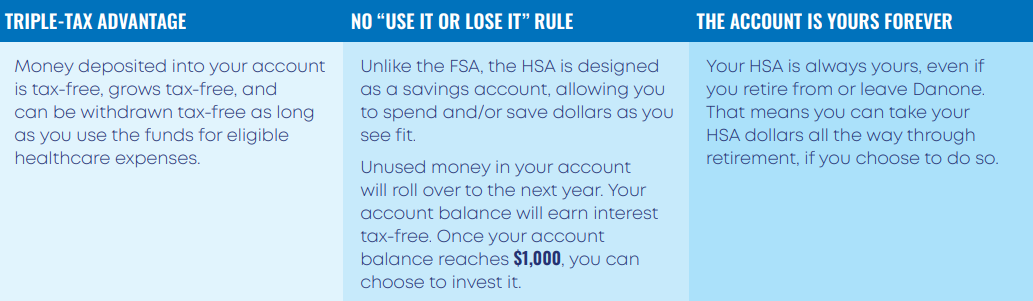

The HSA is a unique bank account that allows you to set aside pre-tax earnings today for tomorrow’s expenses. It gives you more control over your healthcare dollars, along with the freedom to use your account balance now or in the future.

When you enroll in the Cigna HDHP Savings or HDHP Plus plans, you gain access to an HSA. Learn more about this unique savings account.

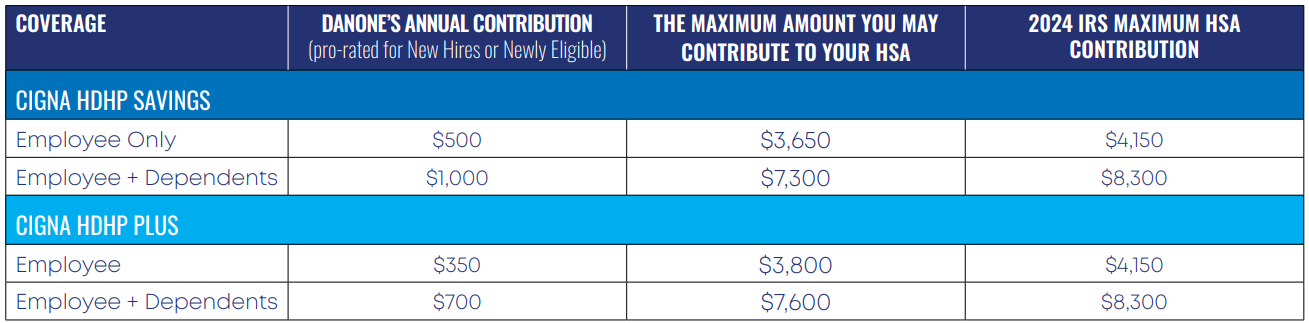

For 2024, you may contribute the following amounts depending on which coverage level you elect. You have the flexibility to change your HSA election at any time during the year. Keep in mind that Danone also contributes to your account.

To access Danone’s contribution, you must attest during the Annual Enrollment event to being eligible to have an HSA. New HSA enrollees are required to complete the Customer Identification Process (CIP). No funds will be deposited into the HSA until CIP is complete and your identity has been verified.

Please Note: It is your responsibility to not exceed the IRS contribution limits when deciding how much to contribute to your HSA.

Important! If you elect an HSA during Annual Enrollment for the first time (or as a new hire), you must open the account within 90 days or you will not receive the HSA employer contribution. It’s important to keep your paystub amount in mind as you will be responsible for making sure you do not go under the minimum wage requirement with your election.

To open and contribute to an HSA, you must be enrolled in the Cigna HDHP Savings or HDHP Plus medical plan. In addition:

You will be asked all of the questions above during your enrollment event to confirm whether or not you are eligible for an HSA in 2024. If your eligibility changes mid-year, it's your responsibility to update this information.

Flexible Spending Accounts (FSAs) are a great way to save money by paying for certain healthcare expenses with pre-tax dollars. FSAs allow you to contribute pre-tax dollars to help pay for eligible out-of-pocket medical, dental, prescription drug, and vision expenses. There is no company contribution to an FSA; it is entirely funded by you.

NOTE: All eligible FSA expenses must be incurred between January 1-December 31,2024. You have until March 31, 2025 to submit your claim for reimbursement.

If you enroll in the Cigna Choice PPO, a regional medical plan (Kaiser or SelectHealth) or waive medical coverage, you can contribute up to $3,200 to a Healthcare FSA in 2024. FSA funds can be used to help pay for many expenses that aren’t covered by your medical, dental, or vision plans, including:

To find a complete list of eligible FSA expenses, please visit the IRS website. Publication 502 lists all eligible Health Care FSA expenses.

If you enroll in the Cigna HDHP Savings or HDHP Plus plans, you have the option to contribute to a Limited Purpose FSA to pay for dental and vision expenses only. This will allow you to save your HSA dollars for current medical expenses or save them for the future.

Savings and spending accounts allow you to contribute money before taxes are withheld to help cover the cost of caring for you and your dependents.

Learn more about our medical benefits, supplemental plans, and savings account options that support you and your family’s wellbeing.

View the prescription drug plans and find out what you will pay under each medical plan option.

To support you and your family, we offer Danoners a range of programs to support mental health and substance abuse. Learn about our comprehensive offering of behavioral and mental health resources.